On 19 June 2023, the Environmental Investment Fund of Namibia (“EIF”) signed a letter of agreement with Climate Fund Managers NL B.V (“CFM”), documenting their intention to establish Nam H-2 Fund Managers (Pty) Ltd (Nam H-2 Fund Managers). The letter of agreement also entails the agreed version of the shareholders agreement governing Nam H-2 Fund Managers.

The African Legal Support Facility (the “ALSF” or “Facility”) is pleased to have supported the Government of the Republic of Namibia (“GRN”) with negotiating the shareholders agreement for Nam H-2 Fund Managers and the letter of agreement. The ALSF assistance included legal advisory support from the international law firm, Allen & Overy LLP, which provided comprehensive advice on the terms and conditions contained in the shareholders’ agreement and the letter of agreement. The ALSF support will also cover the review and negotiation of the governance structure and management agreement of Nam H-2 Fund Managers.

Nam H-2 Fund Managers will be incorporated in accordance with the Companies Act of the Republic of Namibia, with the objective of raising, deploying and managing SDG Namibia One Funds.

SDG Namibia One was launched at the margins of the 27th United Nations Climate Change Conference (“COP27”) held in Sharm el-Sheikh, Egypt, in 2022, as a blended finance platform to establish, facilitate and coordinate raising of capital to develop, invest and operate green hydrogen projects and associated infrastructure in the Republic of Namibia. The platform aims to raise up to EUR 1 Billion by the end of 2023, and takes the form of a partnership between CFM and EIF, with each party holding 51% and 49% equity stake in the establishment respectively.

The signing of the letter of agreement and conclusion of the shareholders agreement between EIF and CFM marks a significant milestone and clear message of intent from the GRN to take an active role in the burgeoning hydrogen sector in the country. Raising investment capital domestically and internationally would undoubtedly unlock investment opportunities critical to the sustainable development of the green hydrogen sector in Namibia.

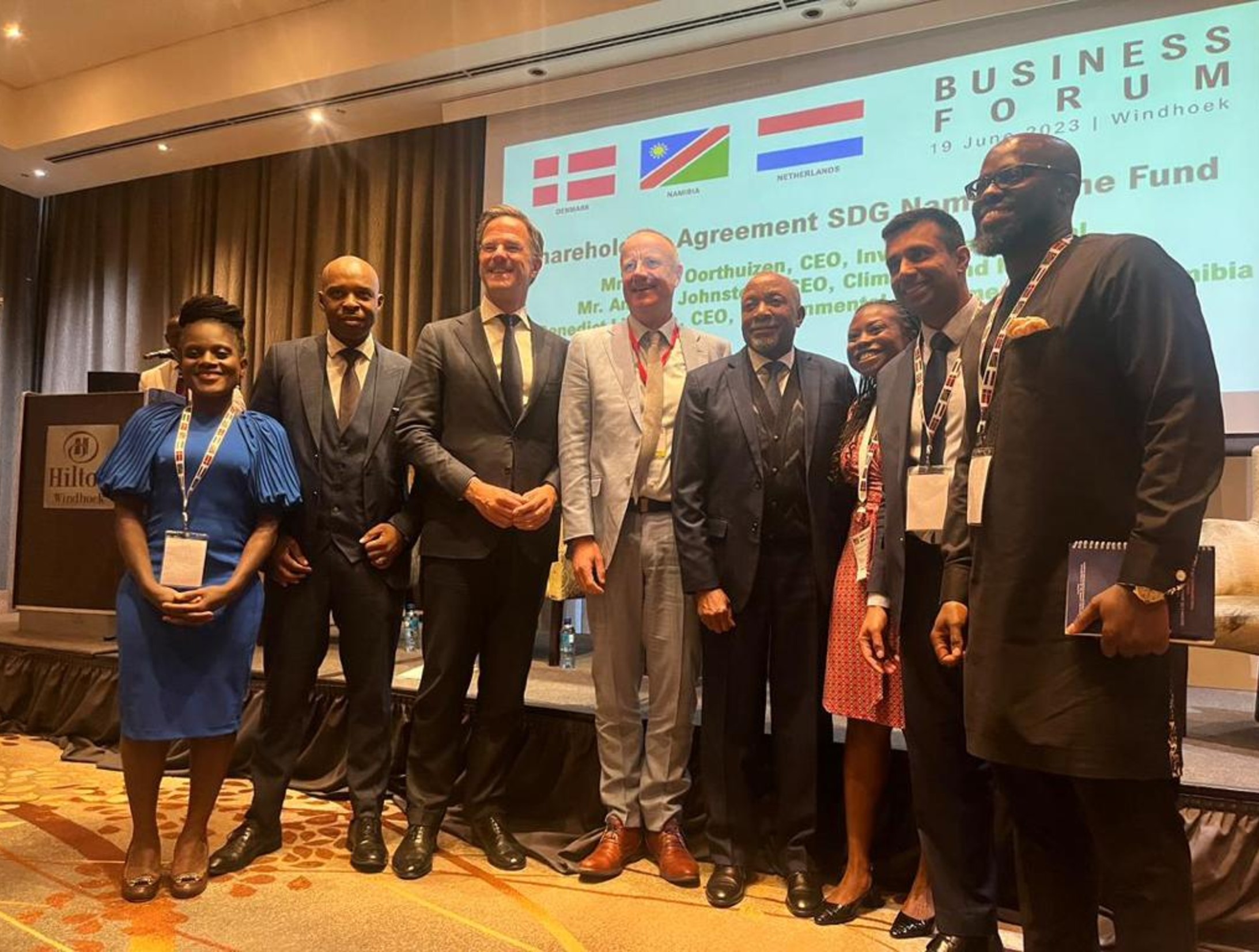

The attached photo was taken following the announcement of the signing of the letter of agreement. From left: Ms. MaameYaa Kwafo-Akoto – Partner Allen & Overy, Mr. Benedict Libanda – Chief Executive Office of the Environmental Investment of Namibia, Mr. Mar Rutte – Prime Minister of the Netherlands, Mr. Joost Oorthuizen - CEO Invest International, His Excellency Nangolo Mbumba – Vice-President of Namibia, Ms. Moni Owoade – Trainee Solicitor Allen & Overy, Mr. Amit Mohan – Head of CFM Debt, and Mr. Mohamed Stevens – Legal Counsel ALSF

Design by Vyou - CopyRight #2019